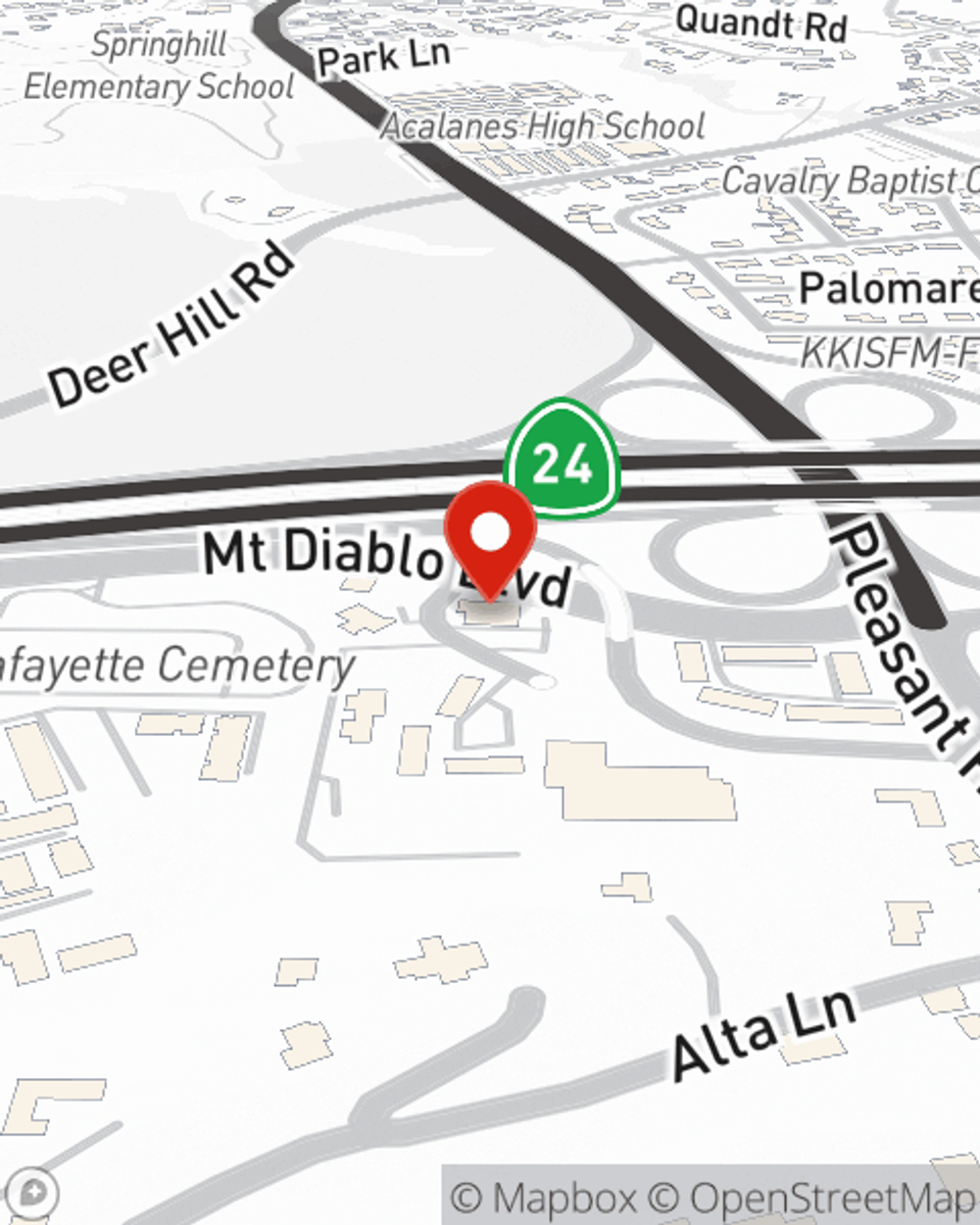

Insurance in and around Lafayette

Bundle policies and save serious dollars

Cover what's most important

Would you like to create a personalized quote?

A Personal Price Plan® That’s Uniquely You

You’ve worked hard to get to where you are. Let State Farm® insurance help protect you, your loved ones and the life you’ve built. From safe driving rewards, bundling options and discounts, you can create a solution that’s right for you. For 100 years, we’ve made it our mission to restore lives, help rebuild neighborhoods, invest in cities, and support education and safety initiatives right where we live and work. It's what being a good neighbor in the Lafayette area is all about. Contact JP Reed for a Personalized Price Plan.

Bundle policies and save serious dollars

Cover what's most important

Our Broad Range Of Insurance Options Are Outstanding

As the largest insurer of automobiles and homes in the U.S., State Farm is equipped and experienced when it comes to helping you protect the life you've built with great claims service, outstanding coverage options and competitive prices.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Liability insurance gaps: What it doesn’t cover and why more protection may be needed

Liability insurance gaps: What it doesn’t cover and why more protection may be needed

Liability insurance doesn't cover your car or injuries. Learn how collision, comprehensive and medical payments can help you achieve full auto protection.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Liability insurance gaps: What it doesn’t cover and why more protection may be needed

Liability insurance gaps: What it doesn’t cover and why more protection may be needed

Liability insurance doesn't cover your car or injuries. Learn how collision, comprehensive and medical payments can help you achieve full auto protection.